Understanding Tractor Insurance Basics: Protecting Your Investment

Owning a tractor is a significant investment, and protecting it with the right insurance is crucial. Unexpected repairs or accidents can quickly drain your resources. This guide helps you navigate the world of tractor insurance, focusing on finding the cheapest options without compromising vital protection. We'll compare USAA and Progressive, two leading insurers, offering actionable steps to secure the best deal. Think of this as your personalized guide to securing affordable and robust coverage for your valuable equipment. For more detailed rate comparisons, check out this helpful resource: Tractor Insurance Rates.

Demystifying Tractor Insurance Coverage

Tractor insurance safeguards you against various risks. Liability coverage protects you if your tractor damages someone else's property or causes injury (a critical aspect often overlooked). Comprehensive coverage protects against theft, vandalism, and damage from events like fire or natural disasters. Collision coverage covers damage resulting from accidents. Choosing between "replacement cost" (covering the cost of a new tractor) and "actual cash value" (considering depreciation) is a key decision.

Two main policy types exist: personal-use policies for personal farming needs and commercial policies for larger operations. Homeowners insurance typically doesn't cover tractors, necessitating a separate policy.

USAA vs. Progressive: A Detailed Comparison

Both USAA and Progressive offer tractor insurance, but their offerings differ significantly. Let's delve into a comprehensive comparison:

| Feature | USAA | Progressive |

|---|---|---|

| Typical Starting Price (Estimate) | Varies; starting around $300 annually (as of September 2023) | Varies; liability coverage as low as $75/year (as of September 2023) |

| Liability Coverage | Available, with customizable limits | Available, with customizable limits |

| Comprehensive Coverage | Available; replacement cost options often available for newer tractors | Available, often includes coverage for accessories up to a certain amount |

| Collision Coverage | Available | Available |

| Discounts | Member benefits, potential bundling discounts | Numerous discounts available, especially for bundling policies |

| Eligibility | Generally more flexible regarding older models, but terms vary | Often stricter, favoring newer tractor models; specifics vary by state |

USAA: Strengths and Weaknesses

- Pros: Excellent customer service reputation, often provides replacement cost coverage, strong community focus.

- Cons: May be more expensive upfront for some, fewer readily available discounts compared to Progressive.

Progressive: Advantages and Disadvantages

- Pros: Typically offers lower starting prices, particularly for liability, extensive discount opportunities, often includes accessory coverage.

- Cons: Eligibility requirements can be stricter, potentially excluding older models; customer service ratings may be lower than USAA's.

Securing the Best Price: A Step-by-Step Action Plan

Obtaining competitive quotes is straightforward. Follow these steps for optimal results:

- Assess Your Tractor's Value: Accurately determine your tractor's worth, including attachments. This is crucial for proper coverage. Consider professional appraisal if uncertain.

- Gather Essential Information: Prepare your tractor's make, model, year, location, and intended usage. Be prepared to answer detailed questions.

- Obtain Quotes from USAA and Progressive: Utilize their online platforms or contact agents directly. Provide accurate and complete information. Inaccurate details significantly inflate premiums.

- Compare Quotes Thoroughly: Analyze coverage limits, deductibles, and any exclusions. Focus on the total cost and value of the policy. Don't just compare initial premiums.

- Select the Optimal Policy: Choose a policy that balances affordability with the protection level you need.

Factors Influencing Your Premium

Several factors impact your insurance cost:

- Tractor's Age and Model: Newer, more expensive tractors typically command higher premiums.

- Location: Higher theft rates in certain areas can increase premiums.

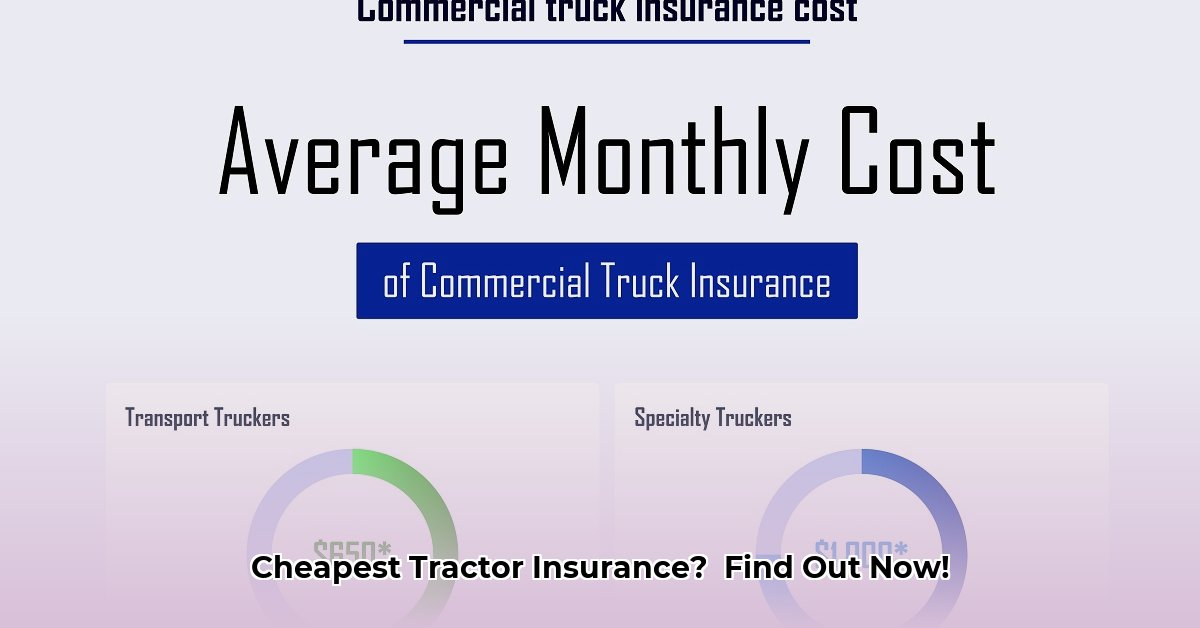

- Usage: Commercial use generally results in higher premiums than personal use.

- Bundling: Bundling with other policies (auto, homeowners) can significantly reduce costs.

- Safety Features: Tractors with GPS trackers or other security features might qualify for discounts.

Additional Tips for Savings

Beyond comparing quotes, these strategies can help you lower premiums:

- Negotiate Rates: Respectfully negotiate with insurers; they may offer discounts.

- Enhance Security: Invest in improved security measures to decrease your risk profile.

- Explore Discounts: Actively search for available discounts; some insurers offer discounts for safety courses or affiliations.

Conclusion: Making Informed Decisions

Finding the cheapest tractor insurance involves careful planning and comparison. Leverage this guide to efficiently find the balance between affordability and necessary protection. Remember, thorough research and comparison empower you to make an informed decision. Don't hesitate to seek professional insurance advice to clarify any uncertainties.